In recent years, Bitcoin has transitioned from a niche digital asset to a mainstream financial instrument, largely due to the influx of institutional investors. This shift has not only driven significant price appreciation but has also altered the dynamics of Bitcoin’s price movements. In this analysis, we delve into the impact of institutional investments on Bitcoin, exploring how this trend has influenced market volatility, price stability, and overall market sentiment.

The Rise of Institutional Interest

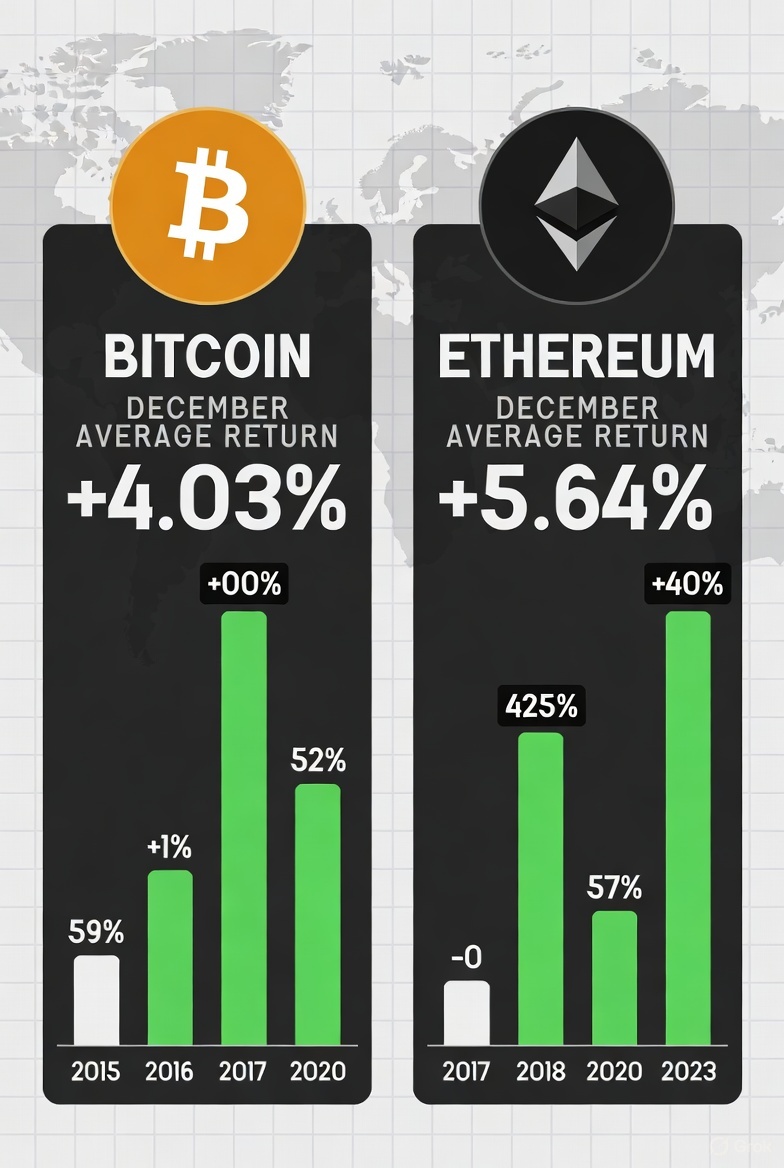

The turning point for Bitcoin came in 2020, when major financial institutions and publicly traded companies began adding Bitcoin to their balance sheets. This was a stark contrast to the early days of Bitcoin, when the market was dominated by retail investors. The entrance of companies like MicroStrategy, Tesla, and Square into the Bitcoin space, as well as the launch of Bitcoin ETFs (Exchange-Traded Funds) in several countries, signaled a growing acceptance of Bitcoin as a legitimate asset class.

Price Stability and Volatility

One of the most significant impacts of institutional investments on Bitcoin is the reduction in extreme volatility. While Bitcoin remains a volatile asset, the magnitude and frequency of large price swings have decreased compared to its earlier years. This can be attributed to the large sums of capital being deployed by institutional investors, which provide a stabilizing force in the market.

However, it is important to note that while institutional investment has brought a level of maturity to the Bitcoin market, it has also introduced new forms of volatility. For instance, macroeconomic events that affect traditional financial markets, such as interest rate hikes or geopolitical tensions, now have a more pronounced impact on Bitcoin’s price. This is because institutional investors often manage diversified portfolios, and movements in other assets can lead to correlated shifts in Bitcoin’s price.

Market Sentiment and Perception

The participation of institutional investors has also influenced how Bitcoin is perceived by the broader public and financial community. Previously viewed as a speculative or even fringe investment, Bitcoin is now increasingly seen as a store of value or a hedge against inflation. This shift in perception has been crucial in driving the adoption of Bitcoin among more conservative investors who were previously hesitant to enter the market.

Moreover, the involvement of high-profile investors and institutions has added a layer of credibility to Bitcoin, encouraging regulatory bodies to take the asset more seriously. This has led to a more robust regulatory framework in many regions, further enhancing Bitcoin’s appeal to institutional investors.

Conclusion

The impact of institutional investments on Bitcoin has been profound, driving price appreciation, reducing volatility, and reshaping market sentiment. As institutional interest continues to grow, Bitcoin is likely to further solidify its position as a key asset in the global financial landscape. However, this new era of institutional involvement also means that Bitcoin will be increasingly influenced by macroeconomic factors, making it essential for investors to stay informed about broader market trends.