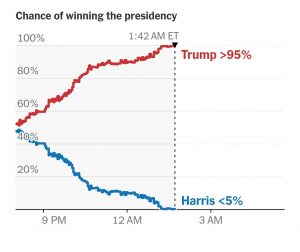

As election night unfolds, the New York Times election forecast model, known as the “Needle,” currently points toward a likely second term for Donald J. Trump, with projected odds nearing 95% and over 300 electoral votes. This real-time prediction model assesses the race based on live polling data, reported votes, and anticipated remaining ballots, making it a distinct tool in election forecasting.

New York Times election forecast model

The Needle was first introduced in 2016 but drew criticism for its dramatic swings during that race. However, after several refinements, it gained credibility by accurately predicting a volatile Alabama Senate race in 2017 and has since been deployed across multiple primaries and general elections.

What sets The Needle apart from traditional election data providers, like AP VoteCast and Edison Research, is its immediate, probabilistic predictions. While AP and Edison tend to hold their calls until a clear outcome is practically certain, The Needle provides near-instantaneous updates, allowing investors and analysts an early glimpse at potential election outcomes—a feature of particular value in a high-stakes election year.

Market Reactions and Bitcoin Surge

The anticipation of a Trump victory has already sent shockwaves through the financial world, notably within the cryptocurrency market. Bitcoin surged to an all-time high as Trump’s track record of crypto-favorable policies and regulatory leniency appears likely to continue. Under Trump’s past term, markets experienced regulatory easing that encouraged digital asset growth, with Trump himself showing signs of optimism toward the sector.

As businesses brace for potential policy continuities, markets are also closely watching the stances of Democratic contender Kamala Harris, whose policies remain ambiguous for the crypto sector. While her “Opportunity Economy” pledge highlights support for innovation, her stance on cryptocurrencies has yet to be fully defined, keeping some investors wary.

As results continue to unfold, the Needle’s projections will keep investors and analysts alike tuned into the potential policy shifts that could shape markets in the months and years ahead.